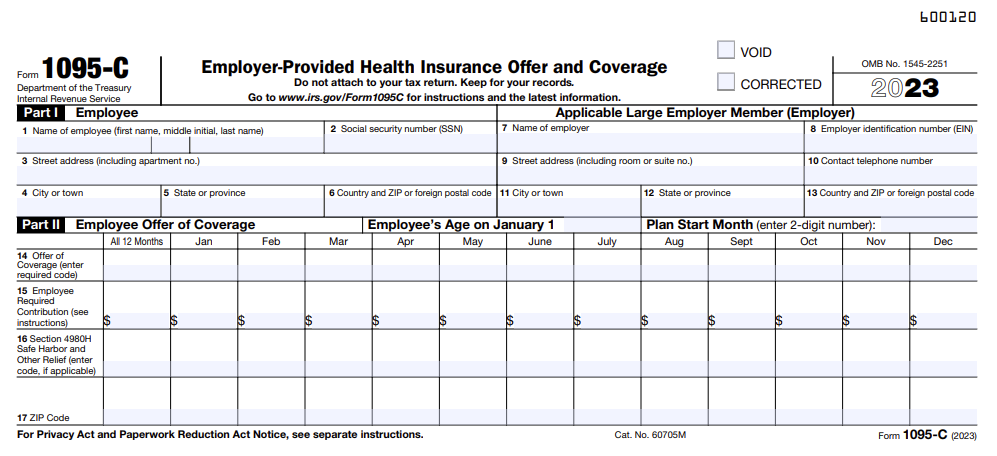

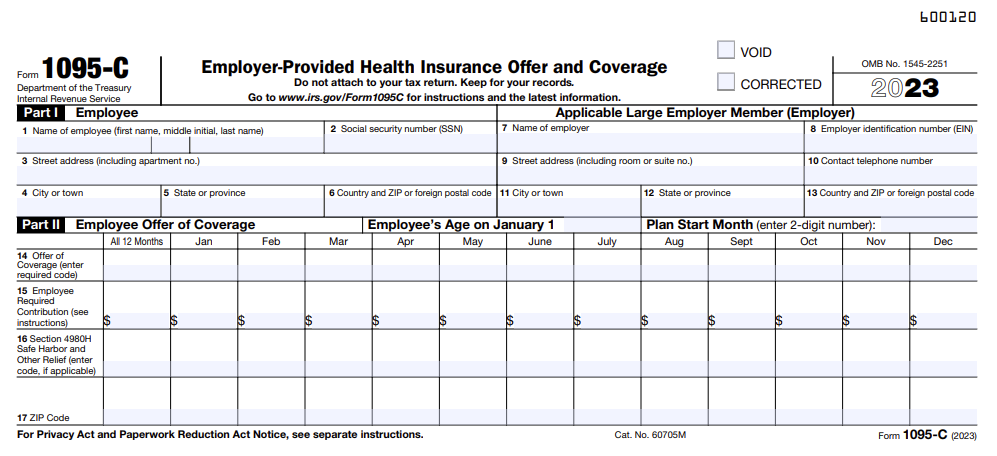

What is IRS Form 1095-C?

As per the Affordable Care Act (ACA), Form 1095-C is used by the Applicable Large Employers (ALE)s to report the health coverage information of their employees to the IRS.

ALEs file Form 1095-C to report the information about:

- Health coverage offered to full-time employees (including spouse, and kids), is required under section 6056.

- Enrollment in health coverage by employees (Including spouse and kids) for employers that sponsor self-insured health plans is required under section 6055.

IRS Form 1095-C Filing Deadline for the 2024 Tax year

Employee Copy Deadline

March 03, 2025Paper Filing Deadline

February 28, 2025

E-Filing Deadline

March 31, 2025Click here to know more about Form 1095-C Deadline for Tax Year 2024.

Information Required to File IRS Form 1095-C for the 2024 Tax Year

The following information is required to file

ACA Form 1095-C:

-

Basic details about the ALE

- Name, EIN, Address

-

Basic details about the employees

- Name, EIN, Address

-

Employee offer of coverage details

- Plan Start Month, Age

- Indicator codes for Offer of coverage

- Safe Harbor Codes

-

Details about the covered individuals

- Name, SSN, months of coverage offered

Visit https://www.taxbandits.com/aca-forms/form-1095-c-instructions/ to know more about 1095-c instructions.

Steps to File IRS Form

1095-C for the 2024 Tax Year

Create a free account with TaxBandits. Follow these simple steps to e-file IRS Form 1095-C with the IRS

Step-2

Enter the required employer details

Step-3

Enter the required Form Information

Step-4

Review and transmit it to the IRS and State.

Step-5

Deliver recipient copies (Online or Postal)

Why choose us to file your 2024 IRS ACA 1095-C Forms

Bulk Filing

Intended to simplify the filing process for employers with large numbers of employees, TaxBandits possess downloadable Bulk upload templates.

You can just download them, update all the information, and upload it back to our system.

Learn morePostal Mail Options

TaxBandits allows you to provide a copy of the tax forms to your recipients.

Before distributing the copy through the US Postal Service, TaxBandits validates all your recipients’ addresses against the USPS database to ensure accuracy.

Learn moreACA Corrections

If you have made any errors in Form 1095-C filed with TaxBandits, you can correct the errors easily without any sort of hassle.

We also take care of the redistribution of the corrected employee copies through our postal mailing feature.

Learn morePrior Year Filing

Not only for the current year (2024), you can also file 1095-C online for the previous years (2020, 2021, 2022, 2023) with TaxBandits. You can easily select a past year return, provide the necessary information, and transmit the 1094 and 1095 forms straight to the IRS.

Learn moreA dedicated Customer support team is always available to resolve any queries you may have during or after the filing process. You can contact us via live chat, phone, and email.

State Filing Requirements to File ACA Forms Electronically

Apart from the federal ACA reporting requirements, the states such as California, Massachusetts, the District of Columbia, Rhode Island, and New Jersey have mandated

state ACA reporting requirements.

The employers in these states should report their employees’ health coverage information to their state agency and may have to furnish the recipient copies if

required

by the state.

Click here to know more about ACA State Filing Requirements.

Frequently Asked Questions

What are the latest updates from the IRS for ACA Reporting 2024?

Like every year, the IRS has released the Draft Form 1095-B/1095-C for ACA Reporting 2024. As per these draft forms, there are no big updates made to existing ACA reporting requirements.

How to extend the Form 1095-C Deadline?

The ALEs can file Form 8809 and get an automatic extension for 30 days from the IRS to file Form 1095-C.

The extension form can be submitted either on paper, or electronically.

Click here to learn more about IRS Form 8809 Extension.

How to correct the errors in IRS Form 1095-C?

If you find errors in the original Form 1095-C filed with the IRS, you need to file a new Form with correct information.

Here are the steps to file a corrected Form 1095-C:

- Prepare a new Form 1095-C.

- Enter an “X” in the “CORRECTED” checkbox at the top of the form.

- Submit the corrected Forms 1095-C with a non-authoritative Form 1094-C transmittal to the IRS.

Learn more about ACA Corrections.

What are the late filing penalties for Form 1095-C?

The aca penalty for failure to file and furnish ACA Form 1095-C within the deadline is $310/return, with the total penalty for a calendar year not exceeding $3,783,000. To avoid these penalties E-File 1095-C and get instant approval from the IRS.

Note: Penalties are also imposed for filing Form 1095-C with incorrect information.